people's pension higher rate tax relief

What is higher rate pension tax relief. You automatically get tax relief at source on the full 15000.

Top Earners Urged To Boost Pensions Before Tax Cuts Financial Times

See reviews photos directions phone numbers and more for 911 Tax Relief locations in Piscataway NJ.

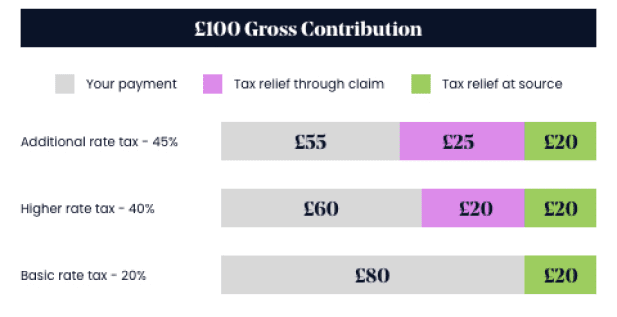

. Peoples pension higher rate tax relief Thursday August 18 2022 Edit. We will mail checks to qualified applicants. You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000.

Attention ANCHOR Applicants. Most of us are aware of the attractive tax benefits that come with our pension. About the Company Higher Rate Tax Pension Relief CuraDebt is a company that provides debt.

You put 15000 into a private pension. How much income tax you pay depends on what band you fall into. Peoples pension higher rate tax relief Thursday August 18 2022 Edit.

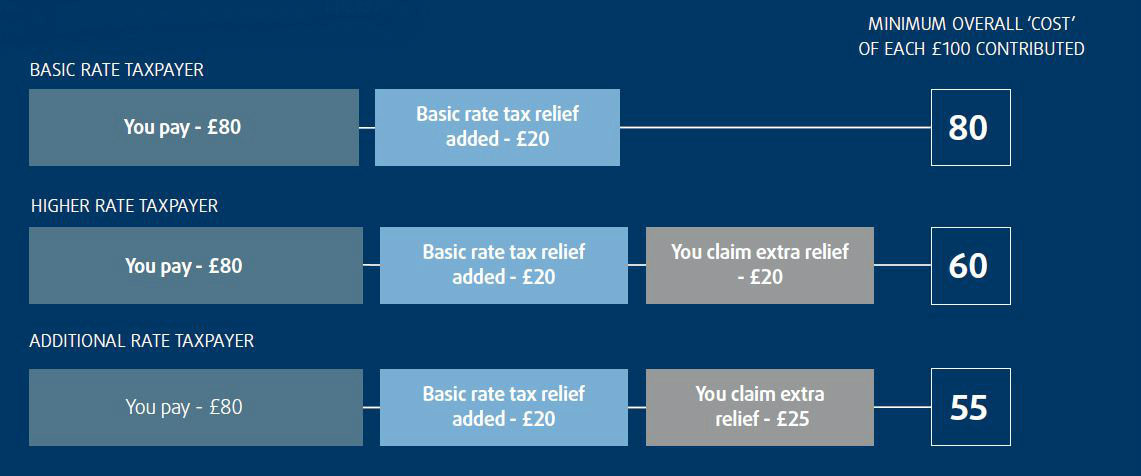

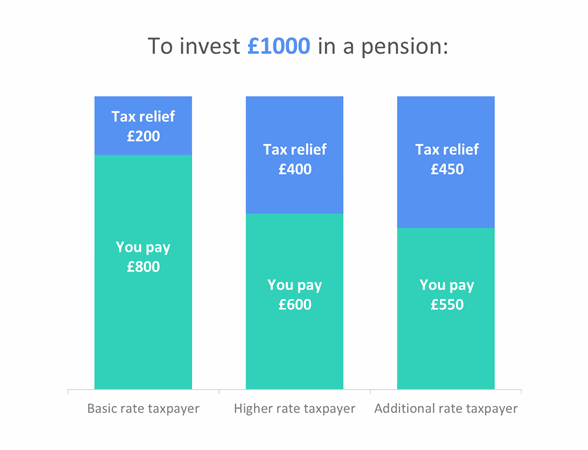

We will begin paying ANCHOR benefits in the late Spring of. Basic-rate taxpayers get 20 pension tax relief. Higher rate tax relief works by increasing the thresholds upon which an investor pays basic and higher rate tax by the amount of gross.

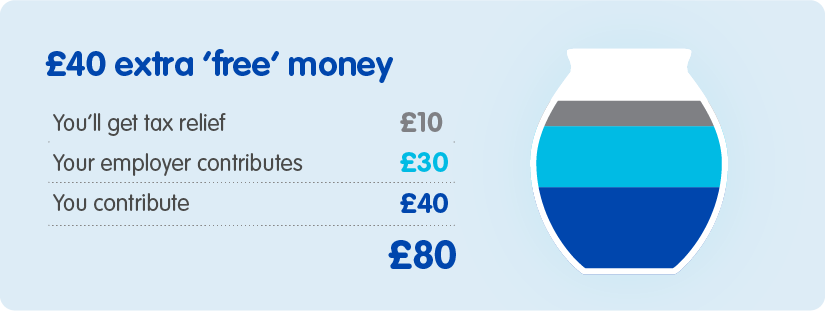

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. A contribution of 100 from your salary into your pension would cost you 80 with the government contributing the other 20. Basic-rate taxpayers get 20.

Calculating the tax relief. A basic rate tax relief of 20 is automatically applied on the whole amount. The combination of paying more tax and coping with a cost of living crisis could force millions of households to the brink.

We all enjoy a 25 tax relief bonus every time we pay in - this comes. The threshold for higher rate tax is. The deadline for filing your ANCHOR benefit application is December 30 2022.

By abolishing the top rate of income tax for the 630000 people earning 150000 or more again it will cut the subsequent pension tax relief. See reviews photos directions phone numbers and more for Tax Relief locations in Piscataway NJ. However people in group stakeholder pension schemes group personal pension schemes and personal pension schemes that they pay into privately will have to claim the.

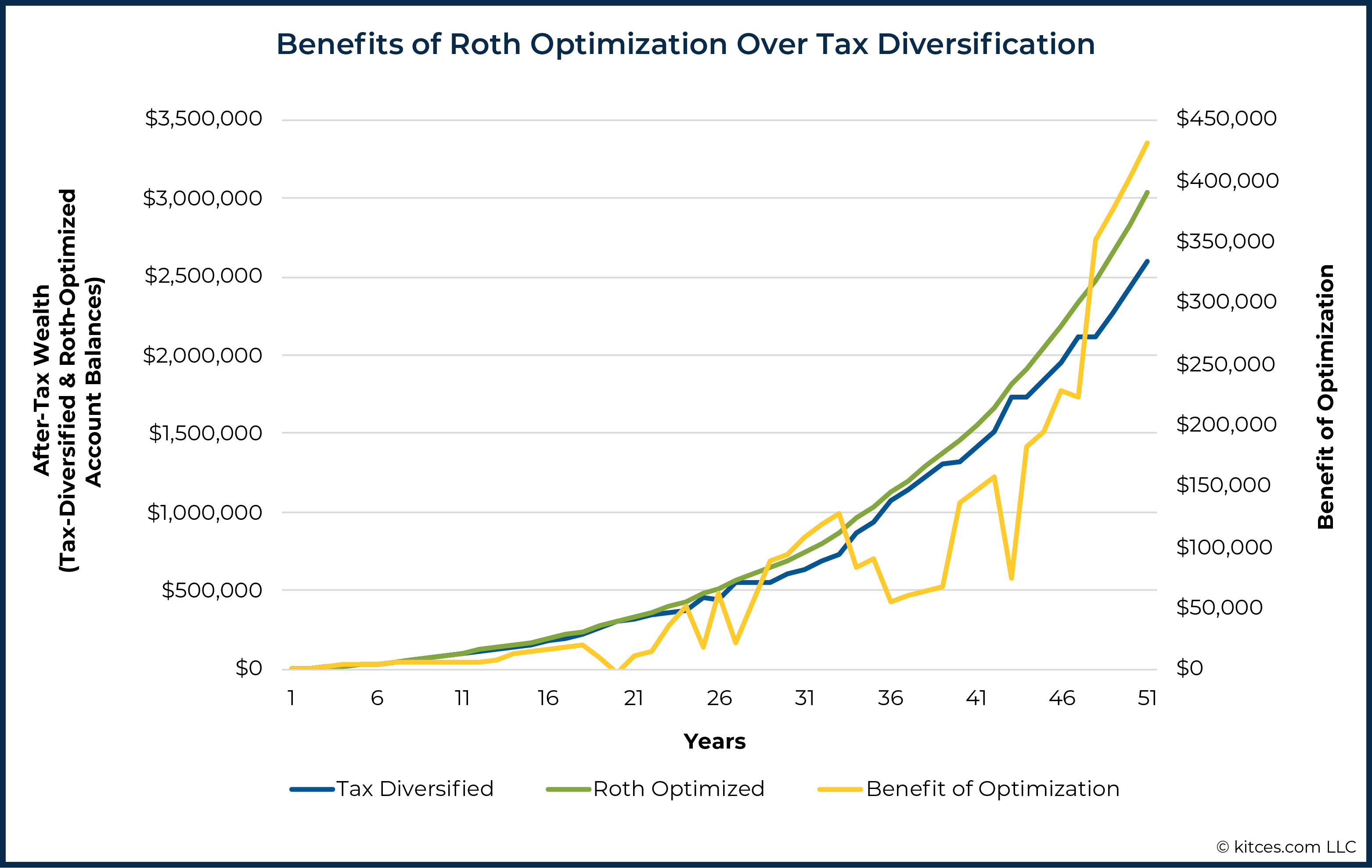

Tax Diversification Limits And Roth Optimization Benefits

Tax Relief On Pension Contributions St James S Place

Now Rishi Sunak Is Coming For Your Pension When You Die Money The Times

Self Employed Pension Tax Relief Explained Penfold Pension

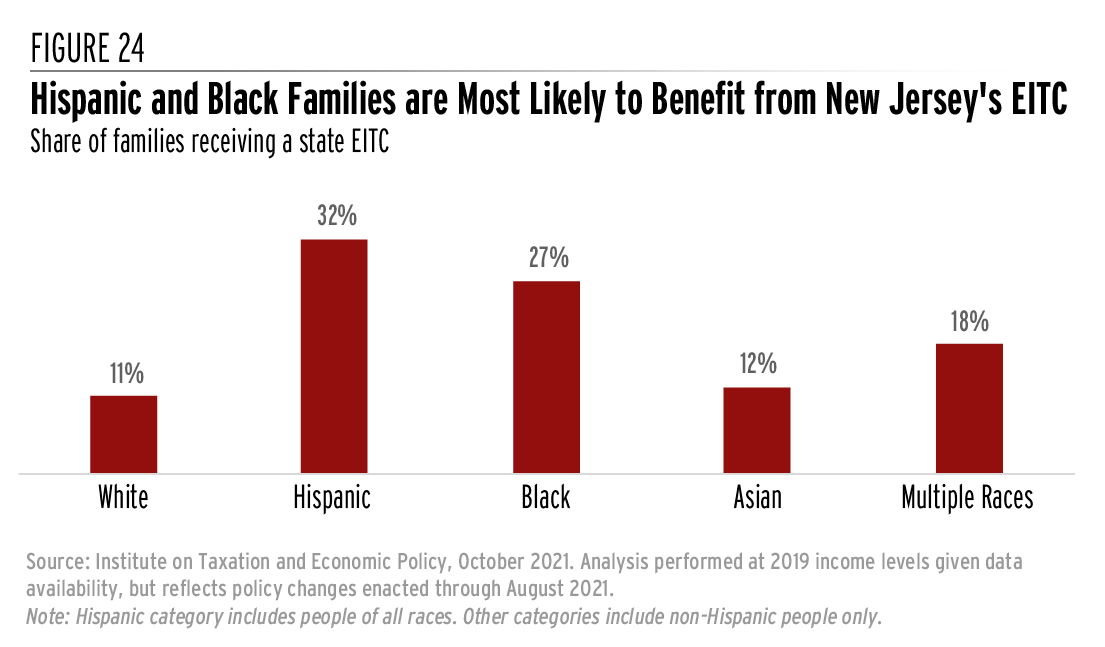

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Social Security United States Wikipedia

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

How Pension Tax Relief Works And How To Claim It Wealthify Com

How Do Pensions Work Moneybox Save And Invest

Newsom Uses Anti Tax Amendment To Give Rebate Calmatters

How To Deal With The Reduction In Annual Pension Tax Relief

High Rate Pensions Tax Relief Faces Axe

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Taxation In Aging Societies Increasing The Effectiveness And Fairness Of Pension Systems G20 Insights

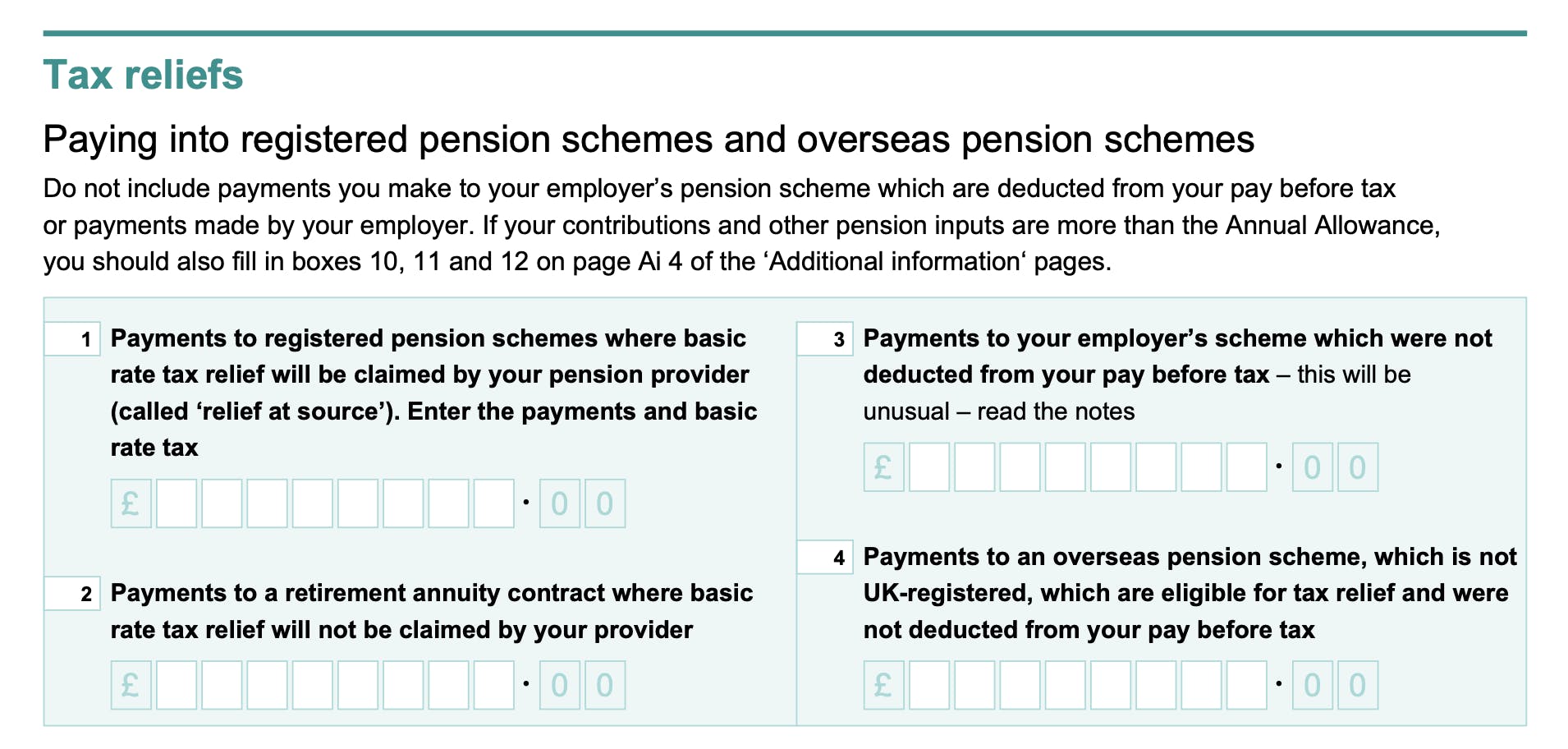

How To Add Pension Contributions To Your Self Assessment Tax Return

Self Employed Pension Tax Relief Explained Penfold Pension

California Retirement Tax Friendliness Smartasset

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

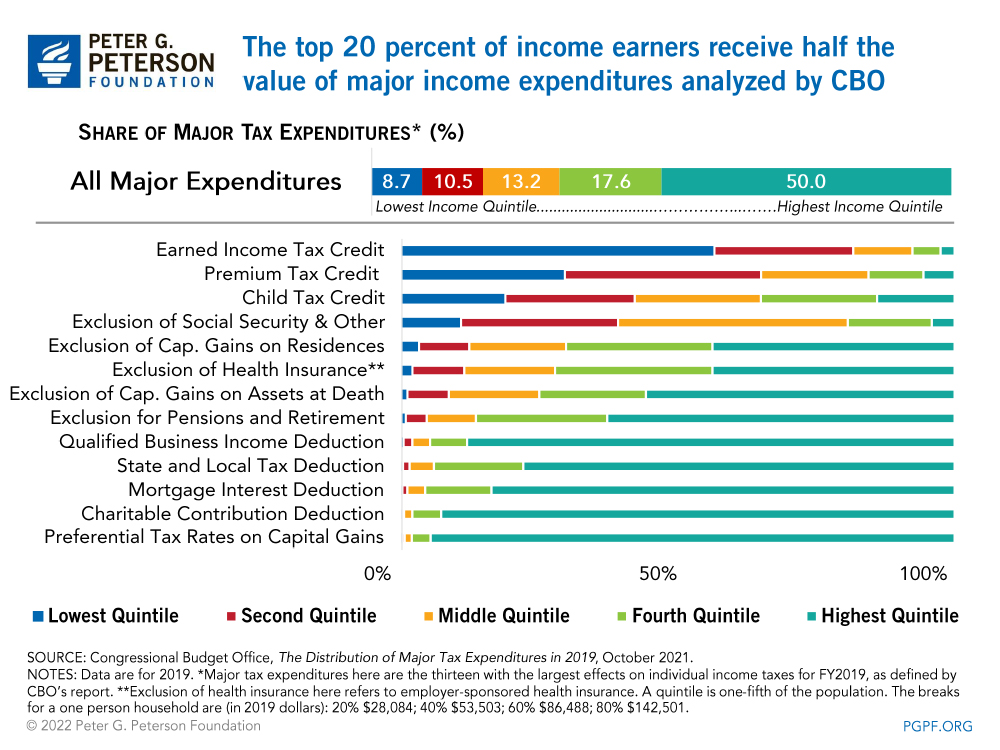

Who Benefits More From Tax Breaks High Or Low Income Earners